AN EXAMPLE OF A DEAL THAT I AM PASSING ON.

- Rick Martin

- Jun 8, 2020

- 3 min read

(QUICK WAYS TO EVALUATE A MARKET BEFORE DIVING TOO DEEP INTO UNDERWRITING).

A potential deal came to me that I quickly passed on, and I would like to share why.

When a broker sends over an offering memorandum (a summary of the deal), it will paint a rosy picture. It is up to us to find the truth. It can take hours or even days to underwrite a deal, so before digging too deep, I will qualify a deal to see if it is worth taking a closer look.

A quick and dirty method is looking up the city on Judgmental Maps (see below). The target property is demarked by the blue circle on the map, and sits dangerously close to an area labeled “TRAILER PARKS.” Probably not a good sign. Better than “Gangs” and “Hookers.” Not a deal-breaker yet.

Another essential first step is to reference a crime heat map. Trulia has one, and as you can see, crime is low here. Low crime is positive. We can keep looking.

It is crucial to determine affordability for the current tenant base. Some will use 33 percent, but I am more conservative and assume a qualifying ratio of 25 percent. That means the rent cannot exceed 25 percent of the median family monthly income. For this particular property, current rents are at $751, but this deal states that even without improving the units, the market rent should be $762. After implementing the value add, they quote an achievable rent premium of $185, bringing the rent up to $947, after renovations. Can the tenant base afford this? What household income is required?

$947/.25 = $3788/month. $3788*12months = $45,456 Required annual income.

Now drill down to the neighborhood where the subject property is located (this example I used city-data.org). At first glance, it looks like the median household income in the area is $112,924, which is plenty to cover $45,456 that is required

It is imperative to be pinpoint accurate because income levels change block to block. When I take a closer look, I see that the subject property is located in the adjacent area, just south:

You can see that the median income drops to $29,928, which does not meet the requirement. This is the deal-breaker. The tenant base can only afford a monthly rent of $623.50 - well below the $945 they are quoting after the value add. Rent growth appears to be maxed out.

Economic diversity and job growth are two other drivers to keep an eye on. The job market is a pretty evenly divided pie chart:

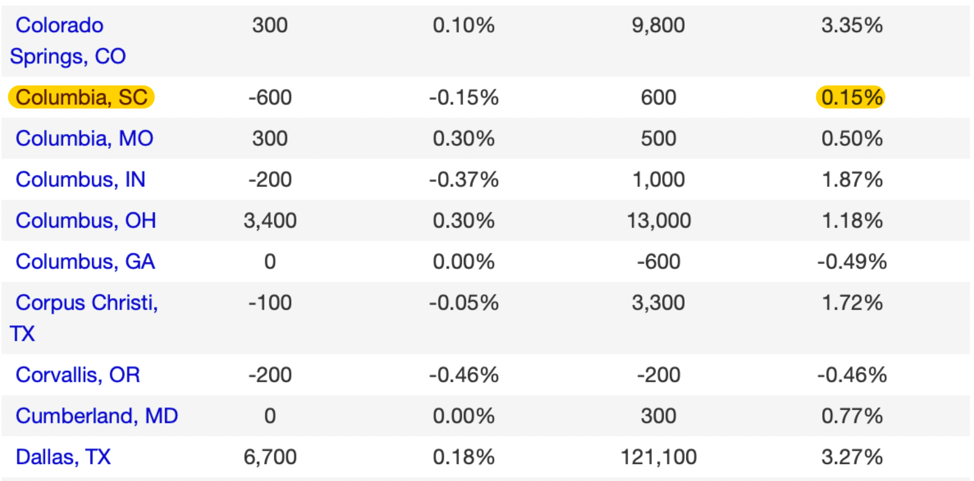

The market will not get too affected by anyone sector pulling back (i.e., the auto industry in the rust belt)- another positive. Unfortunately, as illustrated by the chart below, job growth is flat. Common sense says where jobs grow, people go. That number on the are right is YOY growth. You would like it to be 2% and above, if possible.

It is not an exact science. I know one syndicator who kills it in flat growth markets. Still, he benefits by vertically integrating his own property management company and is outstanding in his operations because of it. It is possible to offset some of these less than desirable market measurables with an exceptional operator. Still, in this case, the underlying economics were not strong enough to continue my analysis, on to the next deal.

Comments