Using Forward Curves to Project Potential Rising Interest Rates in Real Estate

- Rick Martin

- Sep 23, 2021

- 6 min read

Updated: Sep 29, 2021

Why would we ever want an adjustable mortgage when we could lock into a historically low fixed rate that we see today? In recent years, we keep hearing things like "there will never be a better time to refinance," and that seems accurate based on current levels. As the federal reserve continues to increase the money supply by printing money and holding down interest rates, we can only assume that higher rates are on the way. As this monetary policy continues in the United States, we may want to lock into a reasonable rate for the next 30 years and never see our mortgage going up. But in this article, we are not talking about the single-family housing market. In the commercial real estate world and specifically in value-added apartments, it is not so fast when choosing fixed debt. "Floating Rate Debt" may be a better fit for your business plan. However, we must protect our underwriting if every expectation is for interest rates to rise. We can accomplish this by using a forward curve.

I have heard three imputable laws quoted in multifamily investing: 1) Invest for cash flow. 2) have plenty of capital reserves. 3) Secure long-term debt. As tempting as long-term mortgage rates are, number three doesn't tell the whole story because it depends solely upon your business plan. If you try to exit that fixed debt, it comes with a stiff penalty.

In value-add apartments, we're looking to increase the value after completing our business plan. A business plan may last 18 to 24 months, and by the time operations have been improved, and the renovations are complete, you can go back to the bank and seek that refinance. Maybe the real estate market is ripe for you to sell at a profit after only a few years.

However, be forewarned that if you have long-term debt, there's a catch. There are stiff loan prepayment penalties that are so rigid that they'll completely wipe out investor returns. When is it appropriate to use fixed-rate debt in multifamily investing if it isn't suitable for the value-add business plan? If you have a stabilized property and are pursuing a yield play, then a long-term fixed debt plan would make sense. In this case, it is a stabilized property, there are no renovations needed, and the asset is already cash flowing.

In the case of Fortress Federation Investments, we're looking for assets that need a little love. We're going to upgrade the building, bring it up to the market, and therefore be able to charge market rents or better. We'll then go back to the bank and seek a refinance to return the investor's capital while they stay in the deal and collect cash flow. It may be time to sell depending on market conditions, even if it is early in your business plan.

Fixed-Rate Debt Can End Up Costing You

But here is the catch. If you have fixed debt on the building, your hands will be tied because of the aforementioned stiff prepayment penalties. So here we are stuck between fixed-rate debt prepayment penalties and record low interest rates with expectations of high inflation (and therefore expected higher interest rates). How do we get out of this pickle? The workaround for fixed debt is floating rate debt or short-term bridge debt that will bridge you into the following loan.

Not only is it more flexible, but floating debt can have lower rates for investors in search of higher returns. In this competitive market, investors will find ways to make a deal instead of finding a deal, and financing plays a role. Easier access to loans eventually caused the financial markets to dry up after the great recession. Negligent lending was one of that recession's negative effects, and although regulation has tightened, it doesn't prevent investors from seeking other, creative ways of achieving a higher yield. Adjustable and floating rates can improve the balance sheets of deals, but proceed with caution and have the proper tools to prepare for interest rate shocks.

If inflationary expectations are that interest rates can only go up here, we must protect our underwriting and this potential risk. We can accomplish this by using a forward curve. By definition, the forward curve is a function graph in finance that defines the prices at which a contract for future delivery or payment can be concluded today. For example, a futures contract forward curve is prices plotted as a function of the amount of time between now and the expiry date of the futures contract. The forward curve represents a term structure of prices.

SOFR and LIBOR Forward Curves

For those that don't know, there are a couple of acronyms called SOFR and LIBOR, and they each have curves that reflect future expectations of the federal open market committee policy. One being the SOFR forward curve, and the other being the forward LIBOR curve. I'm not going to get too deep into what SOFR and LIBOR mean, but as a high level analogy, think of them sort of like the prime rate. Lenders then add their points to make their money and create the spread and the effective interest rate that the borrower has to pay. So you might hear someone say the interest rate is currently two points over LIBOR.

1-month and 3-month USD LIBOR forward curves represent the market's expectation of future fixings derived from readily observable trade data, including Eurodollar Deposits, Eurodollar Futures, and LIBOR swap rates. The Secured Overnight Financing Rate (SOFR) forward curve represents the implied forward rate based on SOFR futures contracts.

The use of forward interest rates has long been standard in financial analysis, such as pricing new financial instruments and discovering arbitrage possibilities. Although the use of yield curves is routine in monetary policy, the use of forward interest rates for monetary policy purposes appears to be relatively recent.

To protect ourselves further, we can purchase interest rate caps that cap interest rate growth at a specific number, no matter the future date. The purchase cap for the example in image 3 below is 5%. The original floating rate is 2.44%.

How Do We Find Forward Curve Data?

We can get this data online and plug it into our model. A couple of sites we use are Chatham Financial and penceford.com. One of my favorite features is looking at the data in the curve view, (below).

or you can find out how many basis points (or percentage points) to add above your initial interest rate on an annual basis.

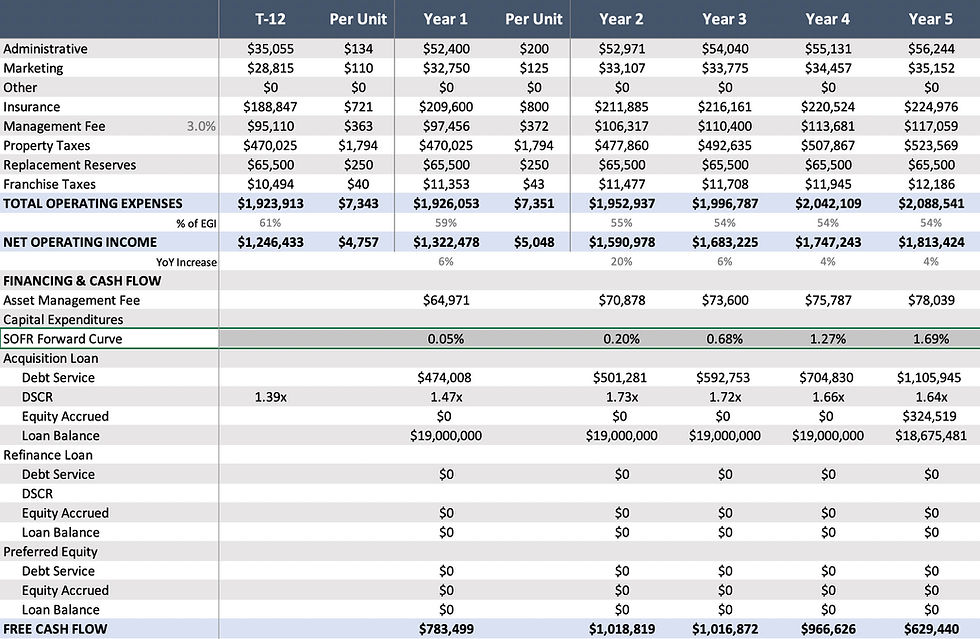

In the example below, although the actual data is different (as this was taken from a different point in time) you can see you take your online forward rates and plug them over and above your real rates in your underwriting model. The model below is from an actual deal this past year, and, as mentioned above, the floating rate was 2.44%. If you add the SOFR curve date below it will be 2.44% + .05% yr1 (2.49%), in contrast to year 5 which projects to 2.44% + 1.69% for a total rate of 4.13%. Definitely an increase from where we started from at 2.44%, and something that has to be accounted for.

Hopefully, you're working with a model or your operator with a model that includes the SOFR and or LIBOR forward curve. This is how we figure potentially rising interest rates into our pro forma and future projections. If a deal you invest in utilizes floating rate debt, put this on your list of essential questions to ask your operator (or yourself if it is your deal!).

We can continue to monitor economic activity, but it is impossible to predict long-term interest rates unless you have a perfectly functioning crystal ball. As we come out of this latest V-shaped financial crisis and appear to be in a cycle of economic recovery, inflation rates are potentially volatile. Although rates will continue to be low on a historical level over the next couple of years, based on the forward curve, the long-term trend will most assuredly reflect rising interest rates. We cannot control the central bank or sharp rises or cuts in short-term interest rates, and we can only control what we can control. So, rather than being caught left holding the bag, smart investors will ensure that SOFR or LIBOR forward curves have been baked into their numbers.

Have questions about investing in real estate syndications? Let have chat.

Comments